Comparing International Travel Insurance: Your Ultimate Guide

Planning an international trip can be thrilling, but let’s face it—navigating travel insurance can feel like deciphering a foreign language. Do you really need it? What does it cover? And how do you choose the right plan? Fear not! This guide will walk you through everything you need to know about comparing international travel insurance so you can travel with confidence.

What is International Travel Insurance?

Definition and Purpose

International travel insurance is a type of insurance that covers unexpected events while you’re traveling abroad. Think of it as a safety net that protects you from financial loss due to medical emergencies, trip cancellations, lost luggage, and more.

Why You Need It for Your Travels

Imagine landing in a foreign country and getting sick or losing your bags. Without travel insurance, you could face hefty bills and endless headaches. Travel insurance ensures that you’re covered for those “just in case” moments, allowing you to focus on enjoying your trip.

Key Features of International Travel Insurance

When comparing travel insurance plans, certain features are crucial to consider. Let’s break down the key components.

Medical Coverage

Medical coverage is often the most vital aspect of travel insurance. This includes:

Emergency Medical Evacuation

If you find yourself in a serious medical situation, emergency evacuation can be a lifesaver—literally! This coverage helps transport you to the nearest medical facility, which can be especially important in remote areas.

Trip Cancellation and Interruption

Sometimes, life throws curveballs. If you need to cancel or cut short your trip due to illness, a family emergency, or even a natural disaster, trip cancellation/interruption coverage can help you recover the costs of non-refundable expenses.

Lost or Stolen Belongings

Lost luggage or stolen items can ruin your travel experience. This feature provides reimbursement for lost, stolen, or damaged belongings, ensuring you don’t have to bear the full financial burden.

24/7 Assistance Services

Many travel insurance policies offer 24/7 assistance services. This means you can get help anytime, whether you need medical advice, lost passport assistance, or emergency travel arrangements.

Types of International Travel Insurance

Travel insurance isn’t one-size-fits-all. Here are the main types you might encounter.

Comprehensive Travel Insurance

This type of policy offers a wide range of coverage, including medical, trip cancellation, and baggage loss. It’s a great choice for most travelers who want a comprehensive safety net.

Medical-Only Travel Insurance

If you’re mainly concerned about health-related issues, medical-only insurance may be sufficient. It typically covers medical emergencies but doesn’t include trip cancellation or baggage coverage.

Adventure Sports Coverage

Are you planning to go skydiving, scuba diving, or hiking in extreme conditions? Regular travel insurance may not cover these activities. Adventure sports coverage ensures you’re protected while indulging in adrenaline-pumping adventures.

Annual Travel Insurance Policies

If you travel frequently throughout the year, consider an annual policy. It provides coverage for multiple trips and can be more cost-effective than buying separate policies for each journey.

How to Compare International Travel Insurance Plans

With so many options out there, how do you choose? Here are some tips for comparing travel insurance plans effectively.

Assessing Coverage Limits

Every policy has coverage limits, which are the maximum amounts your insurer will pay for specific incidents. Make sure these limits align with your needs—medical coverage should ideally cover potential expenses in your destination.

Understanding Exclusions

Read the fine print! Policies often have exclusions—situations or circumstances that aren’t covered. Knowing these can save you a lot of headaches later. For instance, pre-existing medical conditions may not be covered, so be sure to check.

Comparing Premium Costs

Cost matters, but don’t choose a policy based solely on price. Compare what’s included for the premium you’re paying. Sometimes a slightly higher premium can provide significantly better coverage.

Reading Customer Reviews

Customer reviews can give you valuable insights into the reliability of an insurance provider. Look for feedback regarding claim processes and customer service—these are crucial when you need help the most.

Top Providers of International Travel Insurance

To make your search easier, here are some of the top providers known for their travel insurance plans.

Allianz Global Assistance

Allianz is a well-known name in the travel insurance industry. They offer a variety of plans, including comprehensive coverage and travel assistance services.

World Nomads

Ideal for adventurous travelers, World Nomads provides excellent coverage for a range of activities. They’re particularly favored by backpackers and thrill-seekers.

Travel Guard

Travel Guard offers a variety of plans, from basic medical coverage to comprehensive policies. Their 24/7 assistance services are a standout feature.

AXA Assistance

AXA is another reputable provider, known for its extensive network and excellent customer service. They offer various plans tailored to different travel needs.

Tips for Choosing the Right Policy

When it comes to picking the right insurance, a little thought goes a long way. Here’s how to narrow down your options.

Identify Your Travel Needs

What kind of trip are you taking? Are you backpacking, going on a luxury cruise, or attending a business conference? Knowing your travel style will help you choose a policy that meets your needs.

Consider Your Destination

Some destinations come with higher medical costs or specific risks. If you’re traveling to a country with high healthcare expenses, ensure your medical coverage is adequate.

Evaluate Your Activities

If you plan to engage in activities like skiing or scuba diving, make sure your policy covers these. Don’t assume that all travel insurance includes coverage for adventure sports.

Common Misconceptions About Travel Insurance

Let’s clear up some myths that could affect your travel plans.

“I Don’t Need Travel Insurance”

Many travelers think they can skip insurance, but this can be a costly mistake. Unforeseen events can happen to anyone—better to be safe than sorry!

“All Travel Insurance is the Same”

Not all travel insurance policies offer the same coverage. They can vary significantly in terms of what they include, so it’s essential to read the details.

Conclusion

Navigating international travel insurance doesn’t have to be daunting. By understanding what it is, the different types available, and how to compare plans, you can ensure a smooth and safe journey. Remember, having the right coverage can make all the difference in how you experience your travels. So, don’t leave home without it!

FAQs About International Travel Insurance

Do I need travel insurance if I have health insurance?

Yes, your health insurance may not cover you while traveling abroad. Travel insurance provides additional coverage for emergencies that your regular health plan might not.

Can I buy travel insurance after booking my trip?

Yes, you can purchase travel insurance anytime before your trip, but it’s best to do it soon after booking to cover any pre-existing conditions or cancellations.

What should I do if I need to file a claim?

Contact your insurance provider immediately to report the incident and gather any necessary documentation, such as receipts or police reports.

Is travel insurance valid for COVID-19 related issues?

It depends on the policy. Some travel insurance plans specifically cover COVID-19 related issues, while others do not. Always check the details before purchasing.

How can I find the best travel insurance deal?

Compare different policies online, read customer reviews, and consult with insurance agents to find the best coverage that fits your budget and needs.

Common Types of Insura0nce Fraud | ||

Cyber Liability Insurance | ||

Comparing International Travel Insurance | ||

Understanding Liability Coverage | ||

Factors Affecting Auto Insurance Premiums | ||

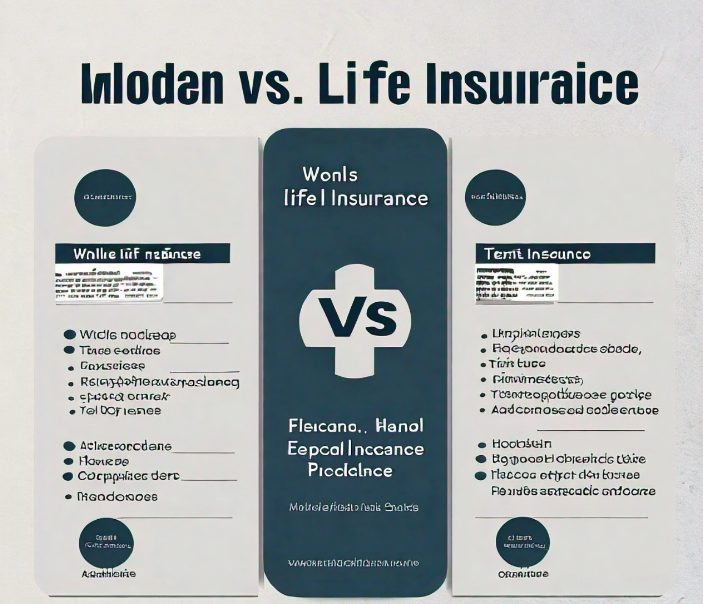

Whole vs. Term Life Insurance | ||

Affordable Care Act (ACA) Plans | ||

How to Protect Yourself from Fraud | ||

Short-term vs. Long-term Disability Insurance | ||

Importance of Business Interruption Insurance | ||

Common Exclusions in Pet Insurance | ||

Essential Coverage For Small Businesses | ||

Best Travel Insurance Plans | ||

Home Insurance For First-Time Buyers | ||

Comparing Care Insurance Rates | ||

Best Life Insurance Companies | ||

Short-term Health Insurance |