Factors Affecting Auto Insurance Premiums: What You Need to Know

Understanding your auto insurance premiums can feel like unraveling a complicated puzzle. Why do some people pay more than others? What exactly influences these costs? In this article, we’ll break down the factors affecting auto insurance premiums so you can navigate your options with confidence.

Understanding Auto Insurance Basics

What is Auto Insurance?

Auto insurance is a contract between you and an insurance company that protects you financially in case of an accident or theft. You pay premiums, and in return, the insurer covers the costs associated with damages, injuries, and legal liabilities.

Why Do You Need Auto Insurance?

Beyond the legal requirement in most states, auto insurance provides peace of mind. It ensures that you won’t be left in financial ruins after an accident. Think of it as a safety net for both you and your vehicle.

Key Factors That Influence Your Premiums

So, what really affects how much you pay for auto insurance? Let’s break it down.

Driving Record

Impact of Accidents and Tickets

Your driving record is one of the most significant factors. If you have a history of accidents or traffic violations, insurance companies see you as a higher risk. More claims often lead to higher premiums, as insurers need to account for potential future costs.

Vehicle Type

New vs. Used Cars

The type of vehicle you drive plays a huge role in determining your premium. New cars typically cost more to insure than used ones because they have higher replacement values. However, if you drive a car that’s known for being reliable and safe, you might get a lower premium.

Safety Ratings and Theft Rates

Cars with high safety ratings often qualify for lower insurance premiums. Additionally, if your vehicle has a history of being stolen, that could spike your rates. It’s a trade-off between performance and safety features versus the likelihood of theft.

Location

Urban vs. Rural Areas

Where you live can significantly influence your auto insurance costs. Urban areas often have higher rates due to increased traffic and a greater likelihood of accidents or theft. On the other hand, rural areas might offer lower premiums because of less congested roads.

Personal Factors That Affect Premiums

Now, let’s look at personal factors that can impact your premiums.

Age and Gender

Generally, younger drivers tend to pay more because they have less driving experience. Additionally, statistics show that young men often face higher rates than women, primarily due to higher accident rates.

Credit Score

Surprised? Your credit score can affect your auto insurance premiums. Insurers often use credit scores as an indicator of risk. A higher credit score may lead to lower premiums because it suggests you’re more responsible.

Driving Habits

How you drive also matters. If you frequently drive long distances or use your vehicle for business, your premiums could increase. Similarly, if you have a habit of aggressive driving, that can lead to higher rates.

Marital Status

Believe it or not, being married can lower your auto insurance premiums. Statistically, married individuals tend to be more responsible drivers, which insurers take into account when calculating rates.

The Role of Insurance Companies

Rating Systems

Each insurance company has its own way of calculating premiums based on the factors we’ve discussed. This means that your premium can vary significantly from one insurer to another. It’s essential to shop around for quotes.

Discounts and Incentives

Many insurance companies offer discounts for various reasons—safe driving, multiple policies, or even being a good student. Don’t hesitate to ask about available discounts; they can make a significant difference in your premium.

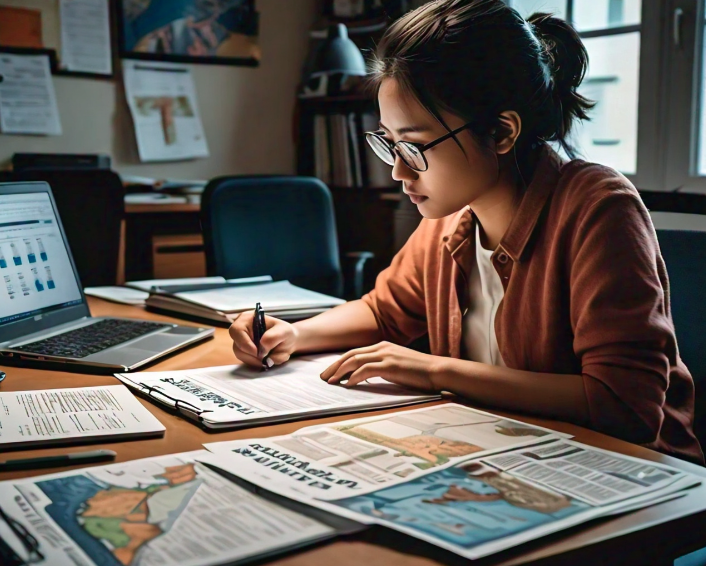

How to Lower Your Auto Insurance Premiums

If your premiums seem high, don’t worry! There are steps you can take to reduce your costs.

Shop Around for Quotes

Don’t settle for the first quote you receive. Compare rates from different insurers to find the best deal. It’s surprising how much rates can vary for the same coverage!

Consider Higher Deductibles

Opting for a higher deductible can lower your premium. Just keep in mind that you’ll need to pay that amount out of pocket in the event of a claim, so make sure it’s a figure you can comfortably handle.

Take Advantage of Discounts

Always ask about discounts! Many insurers offer reduced rates for safe driving, good grades, or even memberships in certain organizations.

Maintain a Good Driving Record

This one’s a no-brainer—keeping a clean driving record will help you avoid rate increases and could even qualify you for discounts.

Common Misconceptions About Auto Insurance Premiums

Let’s bust some myths that might be clouding your judgment.

“All Insurance Companies Charge the Same”

Not true! Different companies have different rating systems, which means the same driver could receive vastly different quotes from various insurers.

“Your Premium Will Never Change”

This is another misconception. Your premium can change based on several factors, including changes in your driving record, vehicle, or even where you live.

Conclusion

Understanding the factors that affect auto insurance premiums is crucial for making informed decisions. Whether it’s your driving record, the type of vehicle you own, or where you live, each element plays a role in determining your costs. By being proactive and informed, you can find ways to lower your premiums while ensuring you have the coverage you need.

FAQs About Auto Insurance Premiums

How often can I change my auto insurance?

You can change your auto insurance anytime. Just keep in mind that you may want to ensure you have a new policy in place before canceling your current one.

What should I do if my premium increases?

If your premium increases, contact your insurer for an explanation. You can also shop around for better rates or inquire about discounts.

Can I lower my premium without changing coverage?

Yes! You can lower your premium by increasing your deductible, taking advantage of discounts, or improving your credit score.

Are premiums higher for young drivers?

Yes, typically, younger drivers face higher premiums due to their lack of driving experience and statistically higher accident rates.

What factors are most important for premium calculations?

The most significant factors include your driving record, the type of vehicle you drive, your location, and personal factors like age and credit score.

Common Types of Insura0nce Fraud | ||

Cyber Liability Insurance | ||

Comparing International Travel Insurance | ||

Understanding Liability Coverage | ||

Factors Affecting Auto Insurance Premiums | ||

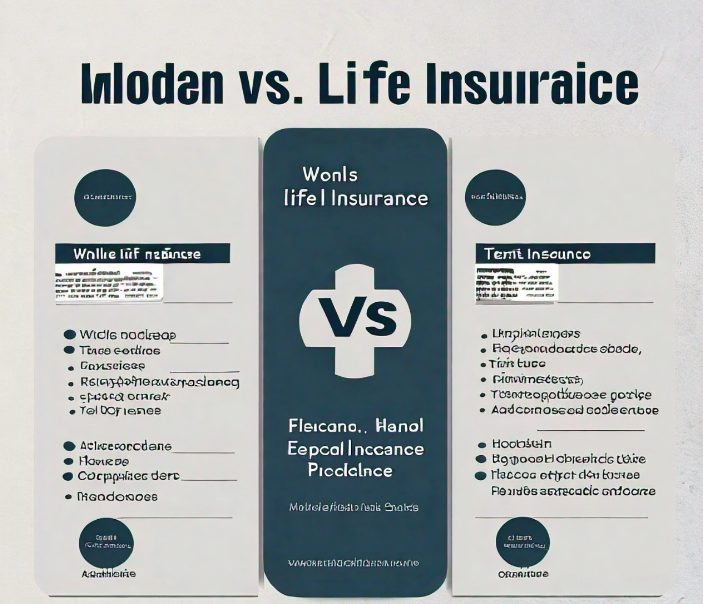

Whole vs. Term Life Insurance | ||

Affordable Care Act (ACA) Plans | ||

How to Protect Yourself from Fraud | ||

Short-term vs. Long-term Disability Insurance | ||

Importance of Business Interruption Insurance | ||

Common Exclusions in Pet Insurance | ||

Essential Coverage For Small Businesses | ||

Best Travel Insurance Plans | ||

Home Insurance For First-Time Buyers | ||

Comparing Care Insurance Rates | ||

Best Life Insurance Companies | ||

Short-term Health Insurance |