Understanding Liability Coverage: The Essential Guide

Liability coverage can seem like a complicated topic, but it’s crucial to understand if you want to protect yourself and your assets. Whether you’re a homeowner, a driver, or a business owner, having the right liability coverage can save you from financial ruin in the event of an accident or lawsuit. So, let’s dive into the ins and outs of liability coverage!

What is Liability Coverage?

Definition of Liability Coverage

Liability coverage is a type of insurance that protects you financially if you’re found legally responsible for causing harm to someone else or damaging their property. It essentially covers the costs associated with legal fees, settlements, and medical bills that arise from such incidents.

Why is Liability Coverage Important?

Imagine you accidentally damage a neighbor’s property or get into a car accident that injures someone. Without liability coverage, you could be facing hefty bills that could wipe out your savings. This coverage acts as a financial safety net, providing you with peace of mind knowing that you’re protected against unforeseen circumstances.

Types of Liability Coverage

Liability coverage comes in various forms, each tailored to specific needs. Let’s explore the main types.

Personal Liability Coverage

This is often included in homeowners or renters insurance policies. It protects you against claims of bodily injury or property damage caused by you or your family members. For example, if someone slips and falls in your home, this coverage can help cover their medical expenses.

Common Types of Insurance Fraud | ||

Professional Liability Coverage

Also known as errors and omissions insurance, this type of coverage is essential for professionals like doctors, lawyers, and consultants. It protects against claims of negligence or failure to perform your professional duties, which can lead to significant financial loss for your clients.

General Liability Coverage

Commonly used by businesses, general liability coverage protects against claims of bodily injury, property damage, and personal injury (like slander). It’s crucial for any business owner, as it can cover legal fees and settlements.

Product Liability Coverage

If you manufacture or sell products, this coverage protects you from claims arising from injuries or damages caused by those products. If a customer gets injured due to a defect in your product, product liability insurance can help cover legal costs and settlements.

How Liability Coverage Works

Understanding how liability coverage operates can help you make informed decisions about your insurance needs.

Basic Principles of Liability Insurance

Liability insurance kicks in when you’re found legally responsible for an incident. For example, if you cause a car accident, your auto liability insurance would cover the other party’s medical bills and vehicle repairs, up to your coverage limits.

Coverage Limits and Deductibles

Every liability policy has coverage limits, which is the maximum amount your insurer will pay for a claim. You’ll also encounter deductibles—the amount you pay out of pocket before your insurance kicks in. Choosing the right balance between coverage limits and deductibles is essential for effective financial protection.

What is Not Covered by Liability Insurance?

It’s vital to know what your liability insurance doesn’t cover. For instance, liability coverage typically won’t pay for intentional acts or damages caused by criminal activities. If you’re operating a business, claims arising from employee injuries may also fall outside general liability coverage, requiring separate workers’ compensation insurance.

When Do You Need Liability Coverage?

Liability coverage is essential in several scenarios. Here’s when you might need it.

Homeowners and Renters

If you own a home or rent, having personal liability coverage is crucial. It protects you from claims related to injuries that occur on your property. For renters, this coverage often comes as part of a renters insurance policy.

Auto Insurance

When it comes to auto insurance, liability coverage is not just a good idea; it’s often required by law. This coverage protects you if you’re found responsible for an accident that injures someone or damages their vehicle.

Business Owners

As a business owner, you should prioritize obtaining general liability coverage. It protects your business from a range of risks, helping you avoid devastating financial repercussions in case of lawsuits.

How to Choose the Right Liability Coverage

Selecting the right liability coverage can feel overwhelming, but breaking it down can make the process easier.

Assessing Your Risk

Start by evaluating your personal or business risk. Consider factors like your profession, lifestyle, and assets. The higher the risk, the more coverage you may need to safeguard yourself against potential claims.

Evaluating Policy Options

Compare different policies and coverage options. Don’t just look for the lowest premium; consider the level of coverage and exclusions. Read the fine print to understand what’s included and what’s not.

Consulting with an Insurance Agent

If you’re feeling unsure, consulting an insurance agent can provide clarity. They can help you navigate your options and find the best policy tailored to your needs.

Common Misconceptions About Liability Coverage

There are plenty of myths about liability coverage that can mislead you.

“I Don’t Need Liability Coverage”

Some people believe they don’t need liability coverage, assuming that accidents won’t happen to them. This mindset can be dangerous—accidents are unpredictable, and not having coverage can lead to severe financial consequences.

“All Liability Insurance is the Same”

Not all liability insurance is created equal! Different policies offer varying levels of protection and cover different scenarios. It’s essential to choose a policy that fits your specific needs.

Conclusion

Liability coverage is an essential part of protecting yourself, your family, and your assets from unforeseen events. Whether you’re a homeowner, a driver, or a business owner, having the right coverage can shield you from financial disaster. By understanding the types of liability coverage available and how to select the right policy, you can ensure you’re adequately protected.

FAQs About Liability Coverage

What happens if I exceed my liability coverage limits?

If you exceed your coverage limits, you’ll be responsible for paying the remaining costs out of pocket. This is why it’s essential to choose coverage limits that adequately reflect your risk.

Is liability coverage mandatory?

While liability coverage is often required for auto insurance, other forms may not be legally mandated. However, it’s wise to have it to protect against potential financial loss.

How can I lower my liability coverage costs?

You can lower your costs by increasing your deductibles, bundling policies, or taking advantage of discounts for safe practices or affiliations.

Does my homeowners insurance include liability coverage?

Most homeowners insurance policies include personal liability coverage. However, check your specific policy to confirm the extent of coverage.

What should I do if I’m sued?

If you’re sued, contact your insurance provider immediately. They can guide you through the claims process and help defend against the lawsuit.

Common Types of Insura0nce Fraud | ||

Cyber Liability Insurance | ||

Comparing International Travel Insurance | ||

Understanding Liability Coverage | ||

Factors Affecting Auto Insurance Premiums | ||

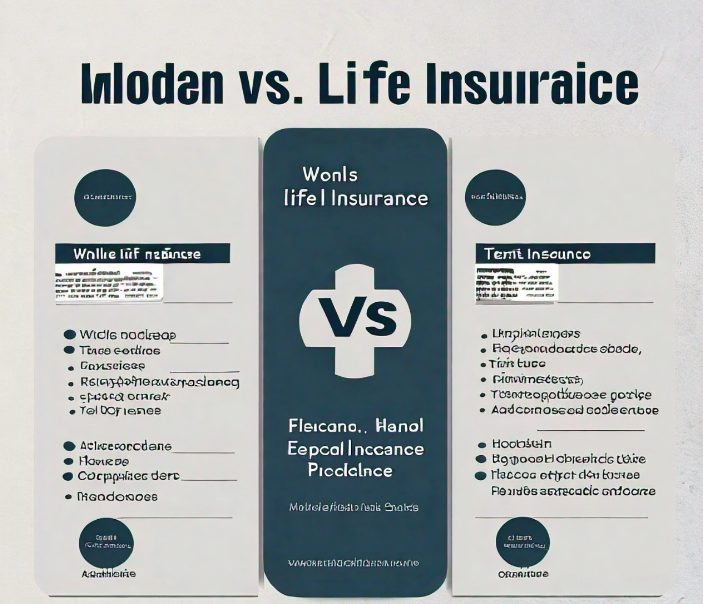

Whole vs. Term Life Insurance | ||

Affordable Care Act (ACA) Plans | ||

How to Protect Yourself from Fraud | ||

Short-term vs. Long-term Disability Insurance | ||

Importance of Business Interruption Insurance | ||

Common Exclusions in Pet Insurance | ||

Essential Coverage For Small Businesses | ||

Best Travel Insurance Plans | ||

Home Insurance For First-Time Buyers | ||

Comparing Care Insurance Rates | ||

Best Life Insurance Companies | ||

Short-term Health Insurance |