Understanding Affordable Care Act (ACA) Plans

Navigating the world of healthcare can feel like trying to find your way through a maze. One crucial piece of that puzzle is the Affordable Care Act (ACA), which has transformed the landscape of health insurance in the United States. If you’ve been wondering about ACA plans and how they can benefit you, you’re in the right place!

What is the Affordable Care Act?

Brief History of the ACA

The Affordable Care Act, often referred to as Obamacare, was enacted in 2010. Its primary goal? To expand healthcare access, reduce costs, and improve healthcare quality. Since its inception, it has aimed to cover millions of uninsured Americans and ensure that healthcare is more affordable and accessible for everyone.

Key Objectives of the ACA

At its core, the ACA focuses on several key objectives:

- Expand access to insurance for the uninsured.

- Lower healthcare costs through various measures.

- Improve the quality of care by implementing new standards and regulations.

- Protect patients’ rights by ensuring that they cannot be denied coverage due to pre-existing conditions.

Types of ACA Plans

When it comes to ACA plans, there are a few different types to consider, each catering to different needs.

Marketplace Insurance

What is the Health Insurance Marketplace?

The Health Insurance Marketplace is a platform where individuals can shop for, compare, and enroll in health insurance plans. It’s designed to help you find a plan that fits your budget and needs.

How to Enroll

Enrolling in a Marketplace plan is straightforward. You typically do this during an open enrollment period, which usually occurs once a year. However, special enrollment periods may be available if you experience qualifying life events, such as losing other health coverage or moving to a new state.

Medicaid Expansion

Who Qualifies for Medicaid?

Medicaid is a state and federal program that provides health coverage for eligible low-income individuals and families. Under the ACA, many states expanded their Medicaid programs, allowing more people to qualify based on income.

CHIP (Children’s Health Insurance Program)

Benefits of CHIP

CHIP offers health coverage to children in families with incomes too high to qualify for Medicaid but too low to afford private coverage. It provides essential health services, ensuring kids get the care they need.

Key Features of ACA Plans

Now that we’ve covered the basics, let’s dive into what makes ACA plans unique.

Essential Health Benefits

All ACA plans must cover a set of essential health benefits, including:

- Emergency services

- Maternity and newborn care

- Mental health services

- Prescription drugs

Preventive Services Coverage

One of the standout features of ACA plans is that many preventive services are covered at no cost to you. This includes vaccinations, screenings, and annual check-ups. It’s a great way to stay healthy without breaking the bank.

No Lifetime Limits

Gone are the days when insurance companies could place lifetime limits on the amount of coverage you could receive. With ACA plans, you can rest easy knowing that you won’t lose coverage once you hit a certain dollar amount.

Protections Against Discrimination

The ACA ensures that individuals cannot be discriminated against based on their health status or history. This means that even if you have a pre-existing condition, you can still obtain coverage.

Understanding Costs Associated with ACA Plans

Let’s get real about money. Understanding the costs associated with ACA plans is essential for making an informed decision.

Premiums Explained

Your premium is the monthly fee you pay to maintain your insurance coverage. It’s important to choose a plan with a premium that fits your budget, but remember, lower premiums might come with higher out-of-pocket costs.

Deductibles and Out-of-Pocket Costs

The deductible is the amount you must pay out of pocket before your insurance kicks in. For example, if your deductible is $1,000, you’ll need to pay that amount in healthcare costs before your insurer starts covering expenses. Additionally, be mindful of co-pays and coinsurance, which are fees you pay when you receive care.

Financial Assistance Options

Subsidies and Tax Credits

One of the most significant advantages of ACA plans is the financial assistance available to help lower-income individuals afford insurance. Subsidies and tax credits can significantly reduce your premiums and out-of-pocket costs. If you qualify, these can make a massive difference in your overall healthcare expenses.

Choosing the Right ACA Plan for You

With so many options, how do you find the right ACA plan? Here are some tips!

Assessing Your Healthcare Needs

Start by assessing your healthcare needs. Do you have chronic conditions? Regularly visit a doctor? Understanding your requirements will help you choose a plan that offers adequate coverage.

Common Types of Insurance Fraud | ||

Comparing Plan Options

Take time to compare different plans. Look at premiums, deductibles, and the network of providers. Websites like Healthcare.gov can help streamline this process.

Factors to Consider

Consider your budget, healthcare needs, and provider preferences. Ask yourself questions like:

- How often do I visit the doctor?

- Do I have preferred healthcare providers?

- What’s my budget for monthly premiums?

Common Misconceptions About ACA Plans

Let’s clear up some myths surrounding ACA plans.

“I Can’t Afford Health Insurance”

Many people believe that health insurance is too expensive. However, with subsidies available, ACA plans can be more affordable than you think!

“Pre-existing Conditions Exclude Coverage”

Thanks to the ACA, you can’t be denied coverage due to pre-existing conditions. This protection is a game-changer for many individuals.

“The ACA is No Longer Relevant”

Despite political debates, the ACA is still in effect, providing millions of Americans with health coverage.

Conclusion

The Affordable Care Act has made significant strides in improving access to health insurance for many Americans. Whether you’re considering Marketplace insurance, Medicaid, or CHIP, understanding your options and the benefits available is crucial. By assessing your healthcare needs and taking advantage of financial assistance, you can find a plan that works for you.

FAQs About ACA Plans

What are the enrollment periods for ACA plans?

Enrollment typically occurs once a year during open enrollment, but special circumstances can trigger additional enrollment periods.

Can I change my plan after enrollment?

Yes, you can change your plan during the open enrollment period or if you qualify for a special enrollment period due to life changes.

What if I miss the enrollment deadline?

If you miss the enrollment deadline, you may have to wait until the next open enrollment period unless you qualify for a special enrollment period.

How does the ACA affect my taxes?

If you receive subsidies, you may need to report them on your taxes. Conversely, if you don’t have health coverage, you might face penalties in some states.

Are ACA plans available for immigrants?

Yes, many immigrants are eligible for ACA plans, depending on their legal status and income. It’s essential to check specific eligibility requirements.

Common Types of Insura0nce Fraud | ||

Cyber Liability Insurance | ||

Comparing International Travel Insurance | ||

Understanding Liability Coverage | ||

Factors Affecting Auto Insurance Premiums | ||

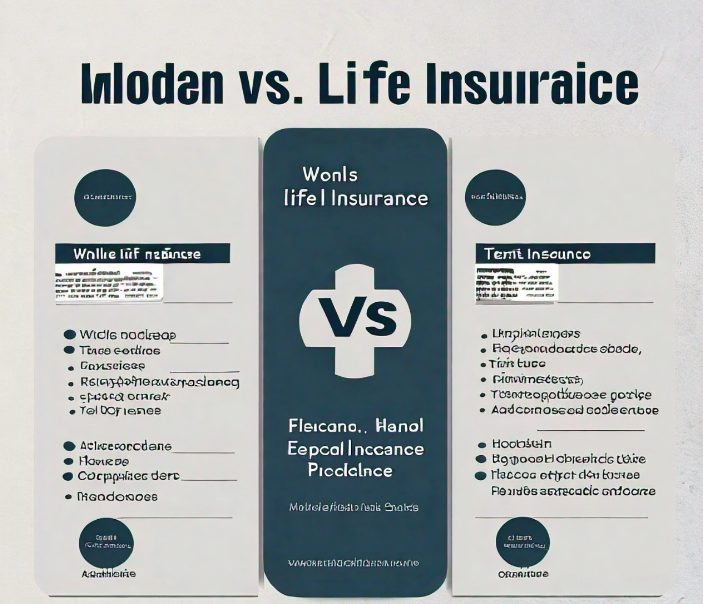

Whole vs. Term Life Insurance | ||

Affordable Care Act (ACA) Plans | ||

How to Protect Yourself from Fraud | ||

Short-term vs. Long-term Disability Insurance | ||

Importance of Business Interruption Insurance | ||

Common Exclusions in Pet Insurance | ||

Essential Coverage For Small Businesses | ||

Best Travel Insurance Plans | ||

Home Insurance For First-Time Buyers | ||

Comparing Care Insurance Rates | ||

Best Life Insurance Companies | ||

Short-term Health Insurance |